Table of Contents

Banking and finance sector has come a long way from the barter system to digital payment solutions. Today, thanks to advancing fintech app development services, we have convenient and secure ways for online transactions. We have entered into the era of cryptocurrency and other financial products.

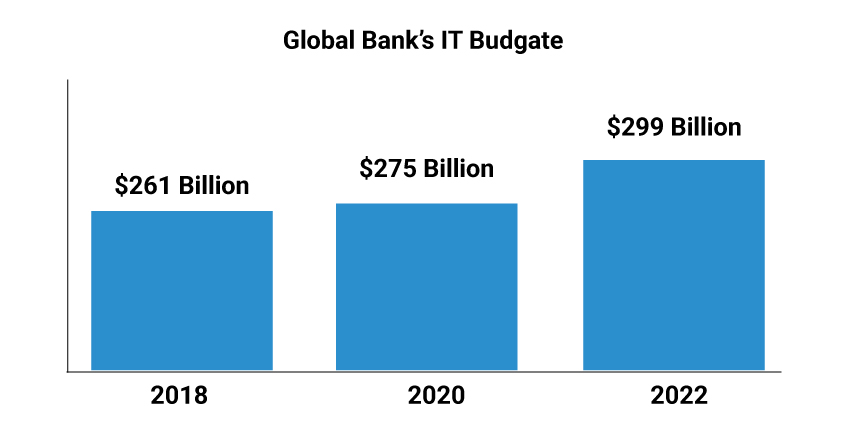

Digital transformation in finance industry works wonders by bringing automation. As banking and financial institutions have started to pay more attention to digitization, we see the rise in the IT budget of banks globally. As per the prediction, the bank’s IT budgets will cross $299 billion by 2022.

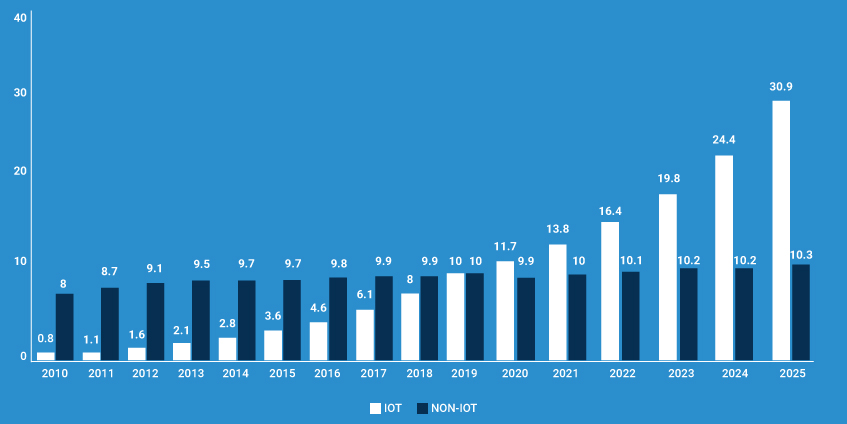

Another study has predicted that the global IoT banking and financial services will grow at a CAGR of over 55% between 2019 and 2027. Simply put, IoT in finance technology seems set to bring change in the way we bank.

The Bank of Things concept has started gaining ground, and the IoT technology brings more data to the sector and assists financial institutions to provide personalized experience and improved services.

Apart from these benefits, there are many other advantages of integrating IoT in finance technology.

As per Statista prediction, the number of connected wearables will reach around 1.1 billion by 2022. In such a scenario, it is fair to mention that IoT will contribute to bringing digital transformation in the fintech industry.

This technology will introduce new methods of payment like biometrical tokens and wearable-based payments.

Let’s go through some top benefits of IoT technology in the finance sector.

Top Benefits of IoT in Finance Sector

Fintech app development evolves rapidly by integrating advancements of emerging technologies including AI, IoT, and blockchain. Here are some of the real world examples of IoT in the BFSI sector.

Cashless Payments

Online payment solutions have become a norm these days. P2P payment apps act as a driver for cashless payments. An IoT app development company can come up with payment solutions for wearable devices.

These wearable-based payment systems will gradually take place of cash and card-based payments. These systems will enable users to pay and check the balance online using their wristbands.

Smart Banking and ATMs

IoT has immense scope in the banking sector. Banks can create a more connected environment by using IoT and offer their customers a personalized experience based on the collected data.

For example, clients can get the details of their accounts on an IoT-based fintech mobile app upon entering a branch. It can give them real-time services.

What’s more, the IoT technology can obtain the customer’s data related to ATM activities and withdrawal patterns. Based on the analysis of this data, banks can strategically place ATMs to increase the customer’s convenience.

Personalized Experience

With the help of an IoT app development company, banks can take a personalized experience to a new level. Today, 79% of the bank’s IT spending revolves around improving customer experience and services.

Fintech companies combine AI and IoT to offer immediate customer support. The branch managers can get the notification on the arrival of customers so that they can effectively allot executives and customers can get real-time assistance.

Optimized Voice Technology

AI-powered voice assistants can assist the banking sector to reduce operational costs. As per the Business Insider Intelligence report, AI voice assistants will reduce operational costs by $8 billion in the year 2022 across the world.

Fintech companies can combine voice assistants with connected devices to come up with interactive and innovative solutions.

Customers can process sensitive financial data including credit or debit card balance, pending transaction details, loan-related information, and the like using optimized voice technology in banks and finance companies.

Enhanced Security

When IoT is integrated into a retail banking application, security and authentication become stronger than ever. Customers can easily log into their IoT-powered fintech apps and make transactions using their fingerprints or a selfie.

This is an additional security feature that can safeguard the customer’s confidential data including bank account details and credit or debit card-related information.

Improved Spending Data

Fintech app development services are designed to leverage the benefits of IoT and AI to improve the app user’s experience. These days, many financial mobile apps tell users about their expenses and savings. Integration of IoT can take this process to the next level.

Users can identify their spending patterns and even break them if necessary. This feature is better than a simple payment statement showing that provides only the spending information.

Better Fraud Detection

An IoT app development company can build a robust fintech app that controls IoT devices with AI-based features. The amalgamation of AI in IoT can make devices more secure against cyber threats.

Now, when devices are controlled through apps, a cyber fraudster cannot make any payments using the user’s stolen data.

Here, customized IoT apps can immediately notify the users and financial institutions to avoid any fraud attempt.

Smart Contracts

Blockchain in fintech sector has many use cases, but the most popular one is smart contracts. IoT enables banks to use these smart contracts that have the customer’s credentials securely.

The advantage of blockchain-powered smart contracts is here the identity credential of the customer is already logged, so it cannot be changed or altered.

Blockchain has a high potential to keep sensitive data protected in the BFSI sector. Commonwealth Bank of Australia and other financial institutions have already integrated blockchain, smart contracts, and IoT into their systems.

Smart Retail Banking

If you plan to build a fintech app, you need to keep in mind how it’ll make banking smarter and more convenient for customers. With the help of IoT technology, connected cars are available as ‘mobile ATMs’ for rural areas. Other opportunities include smart housing and wearable banking.

Many banks provide dedicated apps for Apple Watch and FitPay. In the coming years, other banks will follow the suit, or come up with their own devices to offer advanced digital payment solutions.

Enhanced Risk Assessment

This is a big benefit for insurance companies and microfinance institutions. An IoT app development company can make an app that can monitor and analyze people’s habits and fetch data related to health and driving in real-time. It enables insurance companies to identify and eliminate risks in giving policies.

For example, vehicle insurers can provide customized policies based on the customer’s driving habits and other factors thanks to IoT technology.

Concluding Lines

In a nutshell, IoT in fintech industry can bring transformation in various processes and enable financial companies or banks to offer more personalized services.

All they need to consult a robust and reliable IoT app development company with their requirements and the customer’s expectations.

Solution Analysts is a leading fintech app development company. We assist fintech startups and financial institutions of all sizes to grow with advanced, user-friendly solutions. Our in-house team of developers can integrate features based on emerging technologies including IoT and AI to make the next-gen fintech apps.

sales@solutionanalysts.com

sales@solutionanalysts.com solution.analysts

solution.analysts