Table of Contents

The fintech revolution is neither a fairy tale nor science fiction. It has started changing the shape of the financial across the world. Quick P2P loans using fingertips, payments through cryptocurrency, and virtual financial advisors- all these aspects and many other things have become a reality thanks to fintech development services. These user-friendly aspects and radical changes in the traditional way of transactions can drive the growth for FinTech startups.

The thriving finance world is no bed of roses. Though one of the most heavily regulated and known as a secure industry, several issues like lack of transparency, slow digitization, and lack of real-time ecosystem keep owners of finance companies on their toes. All these issues and several malware attacks like a Trojan horse virus Ramnit have brought up the necessity of technological advancements and an innovative approach.

This innovative technology for the finance sector is known as Fintech or Financial technology. Today, fintech has evolved beyond the BFSI sector to revamp all major industry verticals significantly. Before digging deep into the impact of fintech on various businesses, let’s go through its scope or services it offers for disrupting modern business. Several fintech solutions including Credit Karma, Mint, and Stripe have changed the way of doing business.

Why Fintech Remains the Driving Force for Business Growth?

Fintech is a disruptive force for all finance-related activities ranging from a swift and seamless online payment to wealth management. Here are the key factors why it can drive growth for various industry sectors.

Popularity of Digital Wallets and P2P Payment Apps

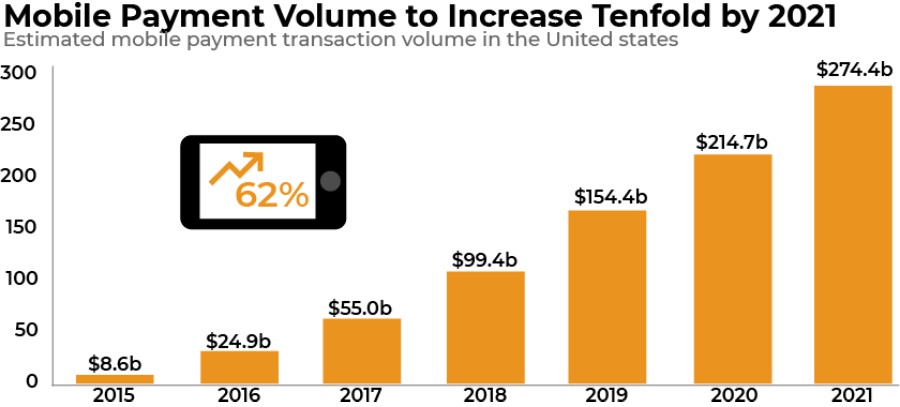

As per the Statista survey, mobile-based transaction volume is set to increase tenfold by 2021 and cross $274 billion in the US alone. Secure and quick online transactions and 24/7 access are some of the major reasons behind the increasing popularity of fintech apps.

What’s more, digital wallets or mobile wallet apps enable users to pay utility bills, transfer money, and pay installments for credit cards. Digital wallets and P2P payment apps offer high convenience to users, and their increasing popularity encourages various businesses to invest more in fintech app development.

Millennial Factor

This is one of the biggest factors that has made fintech a growth driver. The Millennial generation is tech-savvy and tends to remain active on various social media platforms. They rely more on the Internet for getting any information including financial advice. This approach has posed a challenge for conventional banking and financial institutions.

An official report says, 1 out of 3 millennials change banks every three months with the expectation of getting desired experience.

Emerging Technologies

Top finance app development companies can integrate advancements of emerging technologies including AI, AR, and machine learning in fintech app solutions. Advanced features based on these futuristic technologies can enhance the customer experience significantly.

Let’s take an example of customer support chatbots. These chatbots are based on AI and remain active on a 24/7 basis to resolve the queries of customers. They can streamline customer interactions and perform key functions. These are the key reasons why chatbots have become an integral part of all the major banks worldwide.

Fintech technology has evolved to make a considerable impact on various industry sectors. Be it eCommerce or manufacturing, startups or large tech companies, almost all major industries have become beneficiaries of the thriving fintech technology.

Key Industry Sectors on which Fintech has Considerable Impact

On-demand Economy

This is one of the biggest beneficiaries of fintech. The thriving on-demand economy is transforming in multiple ways from customers and service providers’ perspectives because of the integration of fintech-based features.

Let’s take an example of a ride-sharing app. The ride payment process becomes seamless and users find it convenient after connecting their bank account to the app’s payment gateway securely. On the other hand, fintech technology enables drivers to get real-time updates on their payments and access to their accounts. In a way, fintech-based app solutions make the financial processes easy in on-demand business.

Retail

Another biggest beneficiary is the retail sector. Fintech software developers can bring a wave of revolution for this thriving sector especially in the customer experience and checkout sections. Retailers can provide an omnichannel experience along with swift and secure online transactions to their customers.

What’s more, the recent trend of integrating digital payment apps with retail and social messaging apps can enable retailers to come up with a centralized platform for receiving payments from all platforms. Customers can checkout from everywhere- the app, website, and even social media platforms. This trend is here to stay.

Crowdfunding

A few years back, startups with innovative ideas found it difficult to gain visibility in the market due to a lack of platform and resources. People and VCs(Venture Capitalists) also remained reluctant because of the fear of frauds. With the advent of customized fintech apps, the crowdfunding process has become more streamlined and effective. Fintech technology nurtures P2P payment and other secure online payment options to assist investors and startups alike.

Established BFSI players can also leverage the benefits of online fundraising platforms to extend their reach and provide better services to their customers. There is no exaggeration in mentioning that fintech technology can bridge the gap between public and private investment while opening new avenues of getting funds.

Read more : 10 Finance App Ideas For Startups to Consider in 2021

B2B Companies

Still in the nascent stage, the fintech revolution gradually gains momentum among B2B enterprises. Many companies have started dealing in cryptocurrencies to promote their cross-border business. Various fintech startups have integrated blockchain technology to enable their B2B clients to accept payment in bitcoins and other cryptocurrencies.

You can hire dedicated finance app developers to come up with robust fintech solutions for B2B and B2C clients.

Healthcare

Fintech has found a place in the healthcare sector by lending a helping hand in the mitigation of various challenges. The healthcare sector is closely associated with the insurance sector, and financial technology can serve the healthcare sector by streamlining insurance and payment-related processes. We have seen the rise of various MedTech startups in recent years. These startups can make the most of fintech for offering unique and user-friendly features. Practo is one such startup.

Top fintech app development companies can assist healthcare organizations to adopt Blockchain technology to ensure secure online transactions and receive cryptocurrency-based payments.

Future Trends for Fintech

Talking about the upcoming fitness trends, as new digital payment solutions will be introduced, we need to pay more attention to cybersecurity. Fintech startups have started giving more focus on innovation amid the global pandemic. Players in the BFSI, retail, and eCommerce sectors keep on inventing new ways to offer relief to their clients. One of the examples is- Revolut has come up with a charity-related feature for users who want to support people affected by the COVID-19 pandemic.

We will witness higher investment in Fintech as these projects have a higher ROI expected over the period. We can also expect that digital-only banks will gain momentum and blockchain technology will play a prominent role.

Concluding Lines

The fintech sector and fintech app development bring complete transformation in traditional transaction methods. In a nutshell, fintech has opened the doors of opportunities for various industry verticals by assisting them to deliver more people-centric services and make more profits. Fintech is all set to bring a major impact on the present and future of the business world, and you can make the most of it with the help of the best fintech development services.

Solution Analysts is one of the top finance app development companies. Our in-house team of experienced app developers can offer the best-in-class fintech development services in a cost-effective way. Do you want to give your startup an advantage of advancing fintech or wish to hire dedicated finance app developers? Simply send us an email at sales@solutionanalysts.com and we will contact you soon with the strategy.

sales@solutionanalysts.com

sales@solutionanalysts.com biz.solutionanalysts

biz.solutionanalysts