Table of Contents

The BFSI sector is thriving at a rapid pace while witnessing a paradigm shift from traditional payment into online payment. Fintech, the term coined after integrating technology in the finance sector, has added convenience for customers and security for the financial institutes. Today, as people tend to make payments online using robust digital payment solutions, the fintech sector can offer a new set of finance app ideas and opportunities to startups.

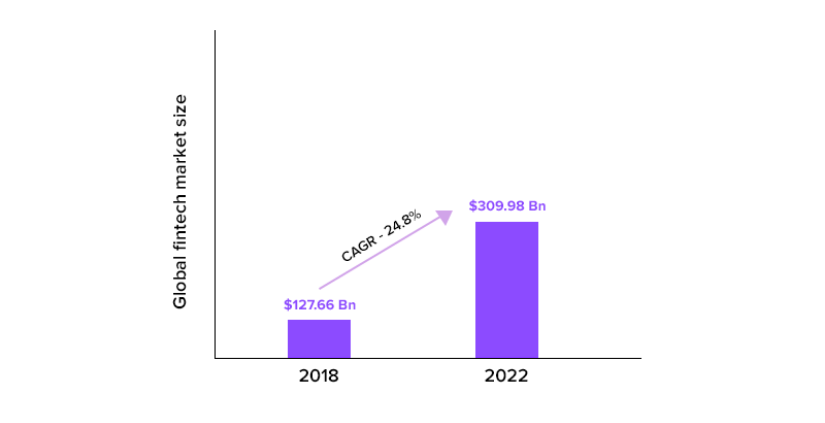

Various entrepreneurs, investors, and financial companies have either moved toward fintech or are planning to make the most of it. As per the prediction of a reputed agency, the global fintech market will grow tremendously to reach $309.98 billion by 2022. If you own a startup or are in search of an idea that can enable you to leverage the benefits of the fintech sector, here we give the top ten ideas that are going to rule in the coming years.

Here we go.

Top Ten Finance App Ideas for Startups

Peer to Peer (P2P) Payment Apps

The peer-to-peer payment market witnesses exponential growth in a couple of years. Google Pay, Venmo, and PayPal are some of the noteworthy examples of P2P payment apps. You can also consider this app to offer your consumers an excellent facility to transfer money instantly across bank accounts and payment systems.

These apps are designed to eliminate the need for any intermediaries, and as a result, the app users can save money in the form of commission fees while making any online transaction.

NFC, face recognition, and voice recognition are the most popular technologies to consider if you want to build a peer-to-peer payment app.

Digital Banking

This is one of the most important Finance App Ideas startups should consider. The Online payment solutions have facilitated transactions and enabled people to make payments online. Banks and financial institutes want to offer a facility to their customers so that they need not visit the branch or even ATMs for money transfer and other reasons. There, digital banking comes into the picture.

The digital banking solutions are designed to assist customers in investing, opening accounts, block or unblocking cards, adding beneficiaries, and the like by using just a few taps on dedicated apps. In this pandemic age, digital banking apps have worked wonders for serving a huge audience online.

Read More : Past, Current, and Future Trends of Mobile Payment Solutions

Financial Advising App

This is one of the most effective ways to attract more people, especially millennials. It is known as Robo-advising software and based on the Machine Learning (ML) concept. These apps are known for giving future-centric financial advice according to the user’s spending habits and income in a personalized way. These apps are intelligent enough to analyze the user’s expenses and investments to calculate after-tax returns.

The financial advising app will remain highly popular among people in the year 2020 and beyond. It will be certainly a beneficial idea for financial startups.

Loan and Credit App

An app for giving loans can give startups an edge in the fintech market. It is also known as P2P lending app and acts as a platform for lenders and borrowers. They can connect and cater to each others’ requirements without using any bank or financial institution.

On one hand, loan and credit line apps enable borrowers to set the maximum loan rates as per their capability, and on the other hand, they enable lenders to bargain with one another in offering loans at the lowest interest rate. In a way, the app can get more users in the form of borrowers and lenders.

Finance Management App

This app is different from a Robo advising or financial advising app. It is also an excellent finance app idea for startups to consider. These days, people are getting more conscious about their earnings and savings. Such finance app not only attract more people but also attract investors for taking the idea to the next level.

Personal finance management apps act as a tool to facilitate app users to segregate their expenses and incomes while getting the real-time report of their financial health. Users can also get a better insight into managing their finances more efficiently. Once the app users integrate all bank and credit card accounts with the app, the data automatically gets updated.

Trading and Investment App

People just love trading in stocks and investing in different funds. How about coming up with an idea to build fintech app that takes care of both trading and investment? Such an app can immediately bring your company into the limelight. You can also consider providing comprehensive insights on shares, forex, and funds in the app to attract traders and investors alike.

The mobile app development company can integrate necessary features based on your budget. You can come up with advanced versions gradually. Here, you need to take budgetary limitations into account, and therefore, you should consult a reputed fintech app development company to make an effective strategy.

Digital Wallet App

These apps have already gained ground in the market. The eWallet app development company facilitates app users to make online transactions without using physical wallets and credit or debit cards. Users can make payments in just a few taps and get discounts or coupons in return.

The digital wallet market is booming and it is predicted that it will reach $7581 billion by the year 2024. It means that there is still a lot of steam left in this market. If a startup wants to come up with a digital wallet app, it can get traction by enhancing security and offering excellent user experience.

Blockchain Apps

Be it a fintech startup or an established finance company, the blockchain technology is useful for all companies in the BFSI sector. These apps can offer plenty of options to users while giving enhanced security while making online transactions. These apps also enable users to transact using cryptocurrencies. We.trade, Circle, etc. some of the highly popular blockchain-based applications.

RegTech App

This is another brilliant app idea for fintech startups. The RegTech App helps financial startups and established institutions to comply with all prevalent standards while automating the processes. Be it a KYC verification or report compilation, the Regtech apps are always useful in the fintech sector. These apps are expected to make a market of over $53 billion by the end of the year 2020.

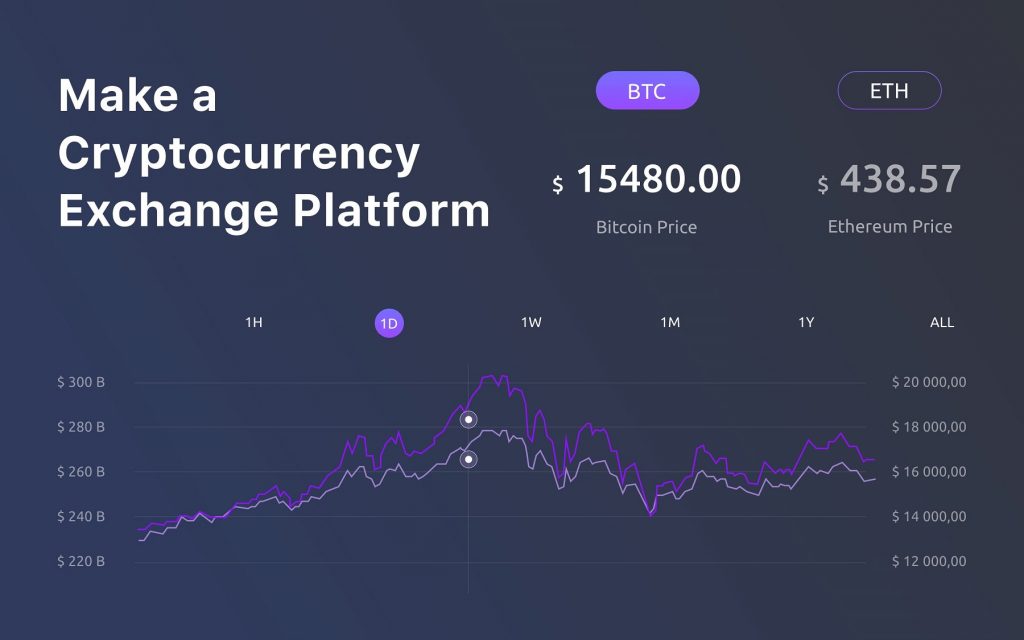

Crypto exchange Platform

This is an innovative and unique app idea for finance startups. The platform can give users an opportunity to enter into the decentralized market of cryptocurrencies. But here, cryptocurrencies are traded instead of other digital currencies. Transparency, lower fees, faster processing, and the highest level of security are some of the best features of the crypto exchange platform.

While choosing any of these ideas, fintech startups have to consider many important factors like compliance requirements, fundraising, identifying niche markets, and getting information about challenges and competitor apps. After doing enough research, the startup should consult a mobile app development company to hire experienced developers.

Concluding Lines

The fintech sector is booming and finance apps are here to stay. Various startups and finance companies enter this market with innovative app ideas. In such a competitive scenario, only apps with user-friendly features, seamless performance, and a bit of creativity with robust security will stay ahead of the curve.

Hope these ideas will help you get rid of hassles associated with a new app. However, it is better to consult a reputed and reliable mobile app development company to get a successful app.

Solution Analysts is a leading eWallet app development company. Our in-house team of expert professionals can help you come up with a user-friendly finance app with desired features in a cost-effective way. Just drop us a line at sales@solutionanalysts.com and our expert consultants will get back to you soon.

sales@solutionanalysts.com

sales@solutionanalysts.com solution.analysts

solution.analysts