Table of Contents

Cash-less, card-less, and yet bankable- the peer-to-peer payment applications are here to stay. In today’s digital world, the ways we shop, work, live, and transact are massively changed to save our time and efforts. Let’s take an example of sending or receiving money straight away using the smartphone. Peer-to-peer or P2P payment applications can make it possible to pay online more conveniently and securely. Let’s understand more about such apps.

What is a P2P Payment Application?

Simply put, the peer-to-peer payment applications are money transfer apps. These apps act as a middleman and help users to send/receive money to and from family members and friends. The peer-to-peer or P2P app is connected to the bank account, credit card or debit card of the users. The money transfer using P2P apps may take either a few minutes or up to three days depending on the bank regulations and prevalent money transfer standards.

In recent times, P2P app development has started gaining ground worldwide. Many startups and entrepreneurs want to leverage the benefits of such apps.

If you want to build a peer-to-peer payment app, then this blog is for you as we dig deep in the peer-to-peer app development.

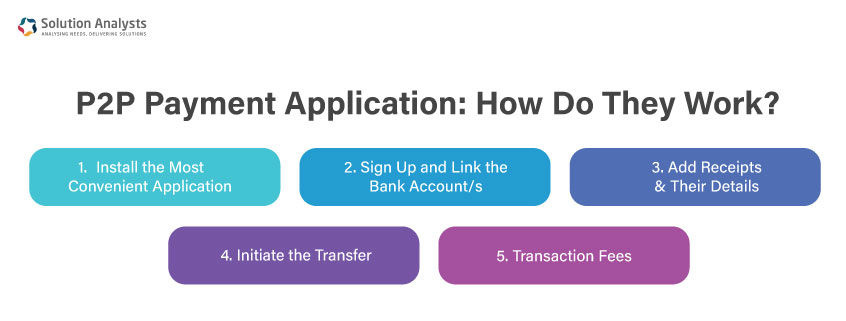

P2P Payment Application: How Do They Work?

As we mentioned above, P2P (peer-to-peer) payment applications enable one account holder to transfer funds to one or more than one account electronically without the need for cash or a checkbook.

In this section let’s understand how it actually works in the real world and the steps that generally people follow to make P2P payments through apps. Here are a few crucial steps:

-

Install the Most Convenient Application:

As the market for P2P payment applications is growing at a rapid pace, users can download the most convenient P2P payment apps on their smartphones. An app can easily be downloaded through the app store or from a specific app website.

-

Sign Up and Link the Bank Account/s:

Users can create an account on the app as well as link their bank accounts including debit/credit cards. This enables them to execute tasks of transferring amounts directly through their bank accounts.

-

Add Receipts & Their Details:

To transfer the funds to the respective account holder, thus, users need to enter account information about receipts. Information basically includes: name, account number, FNIS number, mobile number and many other details.

-

Initiate the Transfer:

To initiate the transfer process, the user has to enter the respective amount they want to send and then select the receipt. There are some Online Money Transfer & Management Application accessible in the market that demand a two-step verification process as well to ensure accurate transfer to the respective person.

-

Transaction Fees:

It is possible that some P2P payment applications charge the sender or receiver or both a fee. These charges vary depending on the app along with the type of transaction users are doing.

Also Read : Developing Mobile Wallet Application- That Everyone Loves!

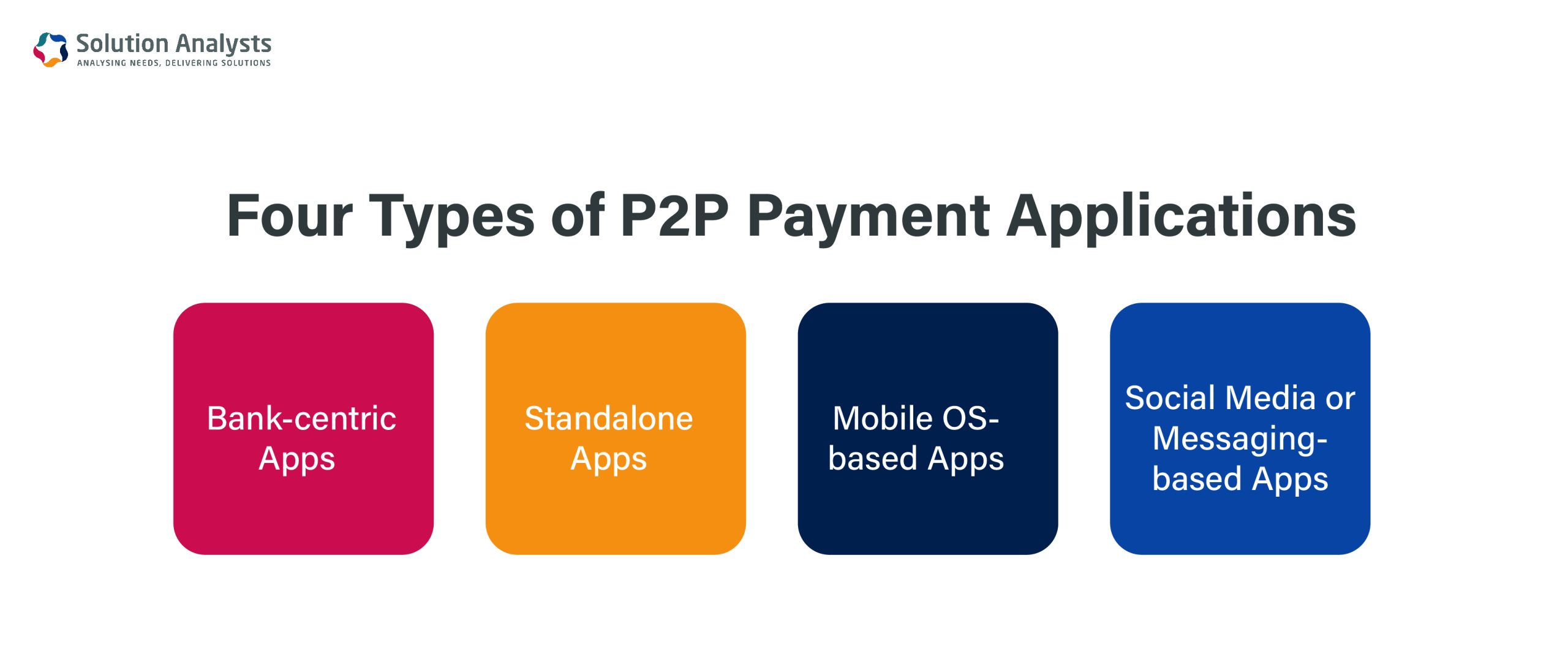

Four Types of P2P Payment Applications

Just like developing an iOS or Android app, extensive research is necessary before developing a peer-to-peer payment app. Here are four common types of peer to peer payment app

P2P Payment Application 1: Bank-centric Apps

P2P Payment Application 1: Bank-centric Apps

Examples are Dwolla and ClearXchange. Many banks have dedicated mobile payment applications or devices that are designed to work with a specific Point-of-Sale (POS). Such apps are capable of withdrawing from or depositing into bank accounts directly. Here, the mobile network operator needs to provide QoS (Quality of Service) assurance.

P2P Payment Application 2: Standalone Apps

Examples are PayPal, Square case. These apps offer both online and in-person P2P payments either in the bank accounts or in the stored currency accounts. These apps have an eWallet feature by default that makes it convenient for the users to either store money or send it to their peers. It is fair to mention that these apps have no support or backing of any banks. Users in developing countries can leverage the benefits of this non-bank model.

P2P Payment Application 3: Mobile OS-based Apps

Apple and Google have their own payment apps known as Apple Pay and Android Pay respectively. These apps or functionality allow money transfers inside their ecosystem only.

This model works wonders in developed countries where the well-established infrastructure for payment in place. Tech-savvy customers or users embrace this model willingly. This model works on tokenization and fingerprint authentication to ensure a safe and swift transaction.

P2P Payment Application 4: Social Media or Messaging-based Apps

Examples are Square Cash and Snapchat. Social media-based payments are useful for sending frequent payments to our contacts. These apps do not require stringent authentication for initiating a transaction because usually such transactions are done among regular contacts.

These apps can remove friction from the entire process. WhatsApp is experimenting with a texting-based money transfer service in India.

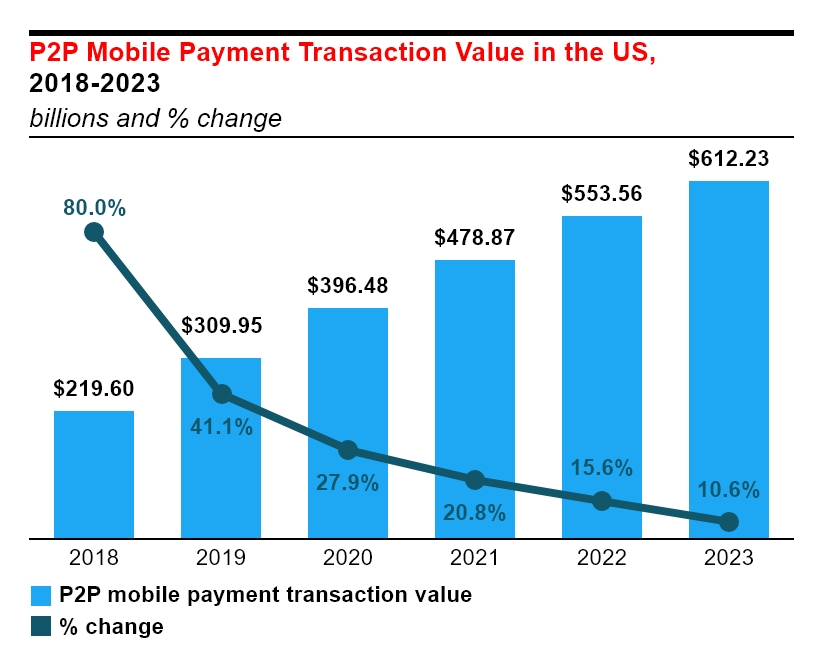

In recent years, P2P payment applications have gained a lot of popularity worldwide. In many regions, they are more popular than bank payment apps. As per the survey conducted by eMarketer, peer-to-peer transactions using mobile phones is expected to reach $612.23 billion by 2023 in the US alone.

This increasing popularity of peer-to-peer payment applications is because of its user-friendly features and excellent functionality. Let’s go through the key features of the P2P payment application.

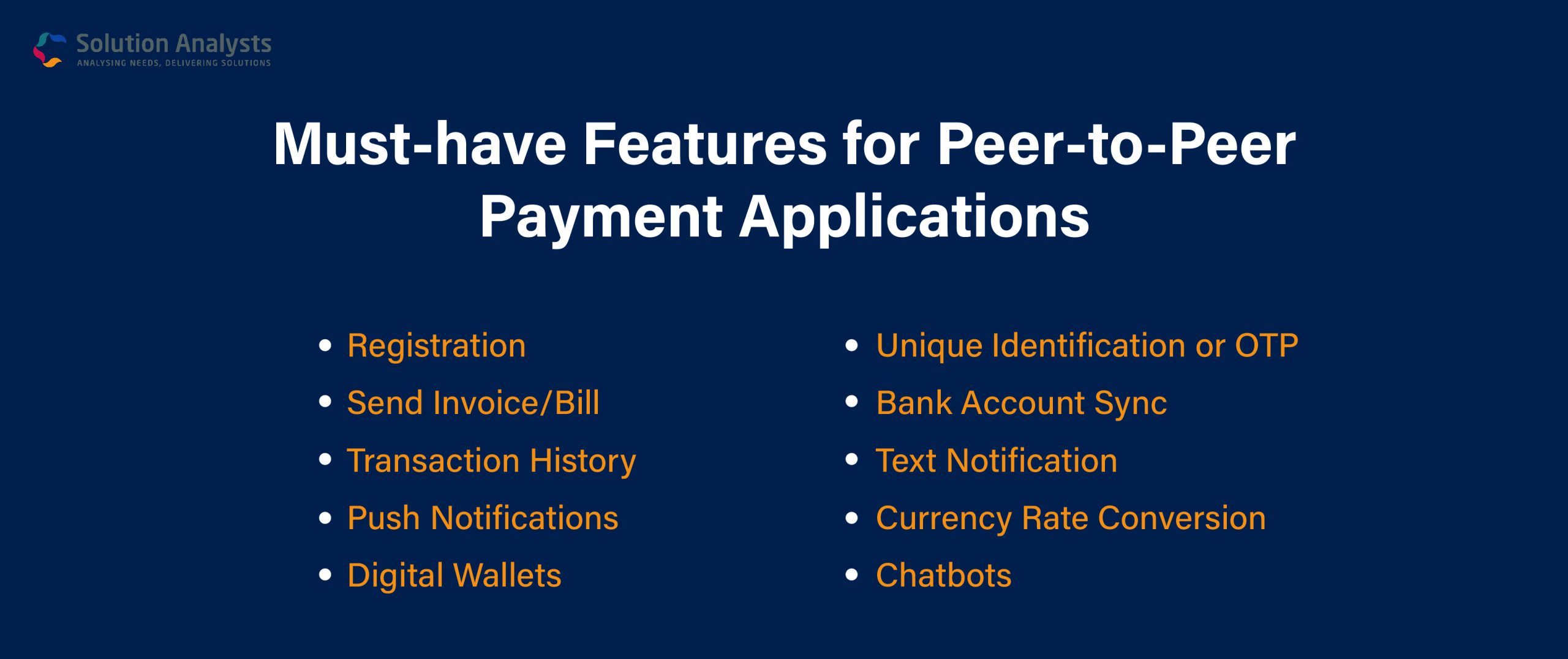

Must-have Features for Peer-to-Peer Payment Applications

The mobile app development company includes the following major features in the P2P payment app. These features will make your app popular and competitive in today’s challenging market.

Registration

Just like a mobile wallet platform, the P2P payment app also needs the user’s registration using a mobile number or social media accounts. Once the registration is verified, users can add their bank details and credit or debit card information. However, standalone payment apps like PayPal do not require you to add bank information immediately.

Send Invoice/Bill

It enables users to send the invoice or bill to the person who is going to make the payment for specific products or services. What’s more, the peer-to-peer payment app should generate the invoice and send the same to senders and receivers.

Transaction History

This feature shows a summary of all transactions on a weekly, monthly, and yearly basis. Every digital payment solution provides this feature to its users. This feature adds convenience as the users can check the transaction history without leaving their homes.

Push Notifications

Ticket bookings, due dates, loyalty points, and many other details can be given through push notifications. This is one of the most important features of the peer-to-peer payment app. The push notifications also notify the users of every payment-related activity.

Digital Wallet

The integration of digital wallets can make the P2P app a complete digital payment solution. This feature replaces the physical wallets and users never lose their money and ATM cards. Even if the user loses the smartphone, it is possible to access the digital wallet from other smartphones or devices. The user’s unique ID and password can protect the amount every time.

Unique Identification or OTP

The finance app development integrates the unique identification or OTP feature in your P2P payment app. This feature sends a unique ID or One-time Password (OTP) to verify every transaction so that the user can confirm it before the amount gets deducted from the wallet or bank account. Some P2P payment apps ask for OTP during every login.

Read More – How Much Does It Cost to Develop an E-Wallet Mobile Application?

Bank Account Sync

Though the Peer-to-Peer app is developed as a strong and safe option to the traditional banking system, many such apps enable users to sync their bank accounts. When the company or entrepreneur wants to build a peer-to-peer payment app, they tend to stay away from enforcing any change from the traditional way of banking, and therefore, they give the bank account syncing feature in the app.

Text Notification

This feature notifies the user when a payment is initiated or received. In brief, whenever any change in the user’s digital wallet occurs, they will get the notification. Also, the mobile app development company can integrate customized alert systems to notify the app users about the upcoming bill payment dates, so they can get rid of remembering important dates.

Currency Rate Conversion

The peer-to-peer payment apps should be capable of handling international transactions. Here the biggest challenge remains is the variation in the currency rates. It is necessary for the app to convert the user’s money in a foreign land.

However, once this feature is provided, it can help people get rid of visiting currency exchange centers frequently. This feature also enables users to transact as per their budget.

Chatbots

Chatbots are aimed at answering queries of a user. Integration of smart bots works as a virtual assistant on a 24/7 basis. The user may want to know many answers before initiating transactions or even registering in the app.

The chatbot is designed to provide quick answers that will enhance the user’s satisfaction and the users remain loyal to the P2P payment app for a long time.

Major Challenges in P2P Payment Application Development Process

The digital payment solution development process has a set of challenges that the app developers need to overcome. We can classify these challenges into two categories-

Technical Challenges

This type includes app security, PCI DSS Compliance, and currency conversion challenges. Features like Touch ID, fingerprint recognition, and two-factor authentication can make the app secure. Also, the P2P mobile application can send instant notification to the users when their money gets transferred or deducted.

Non-technical Challenges

This type includes regional or country-wise limitations, jurisdiction-related challenges, and mindset-oriented issues. Mostly, non-technical challenges occur because many people still do not want to share their confidential financial data online.

P2P Payment Application Types

Peer-to-peer payment applications are mainly of three types- Native, Hybrid, and Web. You need to consider various aspects while determining the type for your P2P application.

- Native apps– These apps can work well on either Android or iOS devices. You can build a peer-to-peer payment app with the help of Android app development or iOS app development.

- Hybrid apps– Web apps wrapped in the native design are known as hybrid apps. Such apps can easily adapt to the interface of the respective OS and devices. However, they are not designed exclusively for any native platform.

- Web apps– These are server-based apps and users can access them across any platform through the Internet. The web app has the same appearance across iOS and Android devices.

How to Secure P2P Payment Apps Using Blockchain Technology

Peer-to-peer networks are highly secure and more reliable than centralized systems. What makes them secure? The answer is Blockchain technology. The cross-border payment is the biggest weakness of P2P transactions.

Banks can send user data with the help of SWIFT and other related technologies during cross-border transactions. Now, this process remains slow, costly, and non-secure.

The blockchain technology can make this process swift and secure. However, the mobile app development company needs to put some effort into giving cross-border transactions a blockchain advantage. Also, the future of peer-to-peer payment apps will be interesting as cryptocurrency and blockchain technology can be integrated.

The blockchain is a public ledger that records all the P2P transactions. It is a highly secure and immutable way to manage P2P transactions.

Also, the hourly rate of developers is the deciding factor. You can get a P2P payment application with necessary features at $30000 from India because the hourly rate of Indian developers is around $30 to $70 an hour, which is way less than the same of the US-based app developers.

Concluding Lines on Building P2P Payment Application

The trend of peer-to-peer payment application gains traction of financial institutions and people alike. As a robust and reliable money transfer solution, this app can take your business to the new level by generating a new stream of revenue. If you want to come up with a customized P2P application, the time is just right as the world rapidly switches to the online payment method.

Solution Analysts is a renowned Finance App Development Company USA, India and many other regions. It specializes in providing customized mobile app solutions, web development and other software services. Do you have any ideas for developing mobile apps? Consult our expert right away

sales@solutionanalysts.com

sales@solutionanalysts.com solution.analysts

solution.analysts