Table of Contents

Digital transformation solutions have a significant impact on the fintech sector. When it comes to driving growth in business for companies ranging from startups to conglomerates, the fintech sector takes advantage of digital transformation.

The pandemic age has tested the global economy by introducing new norms like work from home and social distance. In this troubled time, companies that have embraced digital transformation could perform well.

Every industry sector recognizes the importance of digital transformation, and the BFSI sector is one of the biggest beneficiaries of it. Talking about the fintech industry, it can bring revolutionary changes in the BFSI sector and makes it ready for the future.

Digital payment solutions are just an example of what fintech can do for the finance sector by implementing a digital transformation strategy.

Fintech gives a competitive edge and opens the doors for innovation for startups as well as established enterprises. It creates new ways for customers to access and use financial services. Be it making payments or managing wealth, people can do all financial activities using their fingertips thanks to digital transformation in fintech sector.

In this article, we will be discussing how digital transformation accelerates the change in fintech industry.

How Digital Transformation Brings Rapid Growth in Fintech

The finance industry tends to retain its traditional perspective and remains sluggish in adapting an innovative approach. But, the COVID-19 pandemic has brought a radical change in this policy and the fintech sector strives to meet the challenges of the financial companies and the expectations of customers. There, digital transformation solutions lend a helping hand to the fintech sector.

Digital transformation in fintech industry can bring changes in line with the market trends, emerging financial patterns, and changing consumer behavior.

For example, these days, cashless and contactless transactions have become the need of the hour, and fintech app development companies can come up with innovative payment solutions with this functionality. Adoption of digital transformation can make it possible.

As per the IDG’s Digital business research, the top industries that have adopted digital-first business strategies are services (95%) and financial services (93%). Digital transformation has a significant impact on the fintech sector.

Let’s go through the major benefits of digital transformation in fintech industry for financial companies before moving to the trends and challenges.

Top Benefits of Digital Transformation in Fintech Industry for SMEs

Financial startups and SMEs can take advantage of digital transformation solutions to expand their businesses and improve services.

More Flexibility

Legacy systems remain ineffective in the current scenario because they are not capable of measuring all the necessary aspects for lending. In other words, traditional lending systems fail to earn revenue for SMEs.

Also, they are more expensive as compared to fintech solutions. Another problem with the legacy lending system is the lack of flexibility.

On the other hand, finance app development leverages the benefits of cloud technology. A cloud-based lending app can integrate with the asset system seamlessly to provide a sustainable and user-friendly digital model for a complete lending solution.

Also Read- How Digital Transformation Impacts the Finance Industry

More Convenience

In this pandemic age, digital payment solutions work wonders. Fintech app development companies develop apps that offer more convenience to users while making online transactions safely.

SMEs and startups in the finance sector can take advantage of the digitally-driven loan disbursal process is robust and secure fintech solutions. It is easy to drive various operations with new offerings for finance companies.

More Efficiency

With improved data analytics and real-time reporting, digital lending platforms have become more efficient. The Know Your Customer (KYC) process has become more convenient and accurate with digitization. In a way, financial companies become more efficient in completing credit processes rapidly.

Also, it is possible to detect fraudulent transactions based on the customer’s behavior and analysis of online transactions.

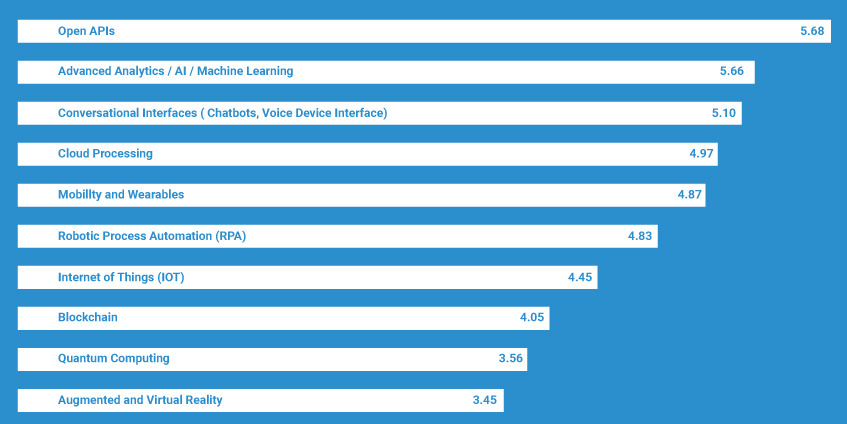

Talking about the digital transformation trends in the thriving financial sector, we can consider AI (Artificial Intelligence), data analytics, IoT (Internet of Things), Open Banking, and automation. Finance app development companies integrate these trends into advanced apps and assist their clients to achieve the following objectives.

Digital Transformation in Fintech Industry- Key Objectives

The evolution of the finance industry is revolving around improved customer experience through innovative apps and excellent services. Here are the major objectives that finance companies can achieve using customized fintech apps.

Improved Collaboration

The team structure is essential for growth and advanced digital solutions can strengthen the team structure through improving collaboration.

Fintech apps can act as a bridge between employees of finance companies and customers for real-time communication. These apps also facilitate employees to get access to the data and communicate with one another in real-time.

Increased Mobile Banking

Mobile banking is on the rise. Fidelity National Information Services (FIS) has revealed that there was a 200% increase in new mobile banking registrations in April 2020.

At the same time, mobile banking traffic rose a whopping 85%. These days, several open banking app development companies are capitalizing on this emerging trend. It is fair to mention that mobile banking and open banking concepts will remain in the post-pandemic period as well.

Better Risk Assessment

AI, data analytics, and blockchain technologies are useful for a quicker and more accurate due diligence process. Be it a merger and acquisition or disbursal of loans, effective risk assessment is achievable through advanced fintech solutions.

Mobile-based Utilities

In this mobile-driven age, mobile wallets and digital payment solutions have become norms. From customers to merchants and service providers to entrepreneurs, everyone prefers mobile-based payments as compared to traditional methods.

Mobile-based transactions are safe, swift, and convenient. Financial companies tend to provide various utilities through mobile apps to their customers.

Finally, if we think of challenges in the way of digital transformation in the finance sector, data security and protection of the user’s privacy remain on the top. Customers provide information related to their bank accounts, credit cards, and debit cards in mobile wallets, digital payment solutions, and other fintech products.

It is imperative for the mobile app development company to come up with robust and secure app solutions that can protect this valuable data.

Concluding Lines

Digital transformation solutions play a vital role in accelerating the growth of the fintech sector. These solutions impact financial service companies significantly through advancing fintech app development services.

It is fair to mention that transformation of internal structures, new ways of customer communication, and improved services will take the entire BFSI sector to a new level in coming years.

We, at Solution Analysts, offer the best-in-class fintech app development services based on the client’s business needs and global trends. Our experienced developers keep the end-users in mind while developing feature-rich digital payment solutions or advanced fintech apps.

We strive for transforming financial companies digitally through high-end finance app development.

sales@solutionanalysts.com

sales@solutionanalysts.com biz.solutionanalysts

biz.solutionanalysts